Stocks fall under fiscal cliff pressure

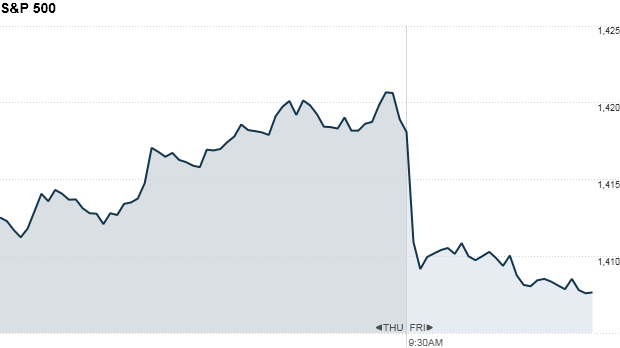

Another day, another sell-off. With no resolution on the looming fiscal cliff, U.S. stocks sold off yet again on Friday.

The S&P 500, the Dow, and the Nasdaq fell between 0.6% and 0.8%, as fears grow about the impact of no deal.

The uncertainty has taken a toll on markets. Stocks have sold off for four straight sessions as hopes for a substantial budget agreement have diminished, and all three indexes are on track to end December in the red.

Friday's sell-off was broad, with 29 out of 30 Dow components in the red. Only American Express(AXP, Fortune 500) eked out a small gain. Stocks have actually had a pretty stellar year, with all three indexes up between 7% and 15%

President Obama and congressional leaders will discuss the fiscal cliff impasse at the White House Friday afternoon, and the House of Representatives will return on Sunday. Investors worry that failure to reach a deal could push the U.S. economy into recession.

Investors are hoping that leaders will at least be able to reach some sort of breakthrough that will postpone at least some of the automatic tax hikes and spending cuts due to take effect on Jan. 1.

"A lot of people are thinking about capital gains consequences and holding positions beyond this year," said Mark Helweg, founder of financial tech company MicroQuant..

Shares of Citigroup (C, Fortune 500), Wells Fargo (WFC, Fortune 500), Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) all declined in early trading. Bank stocks were among the biggest drags on the market Thursday.

Investors shrugged off two better-than-expected economic reports Friday morning. Readings on both the Chicago purchasing managers index and pending home sales for December rose more than expected.

Shares of Hewlett-Packard (HPQ, Fortune 500) fell after the company announced that the Department of Justice is investigating possible accounting fraud at Autonomy. After acquiring Autonomy for $11 billion last year, HP took an $8.8 billion write-down related to the acquisition this year.

Shares of Barnes & Noble (BKS, Fortune 500) rose 9% after British publisher Pearson(PSO) announced that it would invest $90 million for a 5% stake in the retailer's Nook unit.

European markets edged lower in afternoon trading. Italy sold €3 billion in 10-year government bonds Friday morning.

Asian markets ended stronger. Japan's Nikkei, which will be closed on Monday, ended the year up more than 20%. The Nikkei's recent strong run comes as the yen has been weakening on the prospect of further monetary easing. The Shanghai Composite posted further gains and is poised to end the year in the black.

The U.S. dollar rose against the euro, but dropped against the British pound and the Japanese yen.

The yield on the 10-year Treasury note moved up slightly to 1.71%. Oil prices were modestly higher, while gold moved slightly.

0 comments:

Post a Comment